Global Market Portfolio

Global Market Portfolio in Theory

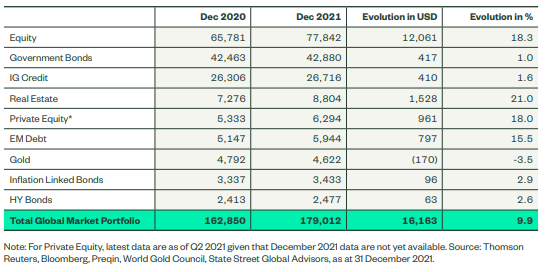

As the name implies, the Global Market Portfolio is a research model representing all financial assets across global markets. The average of all investors. Depending on the specific model cited, it might include public and private equities, bonds, real estate, commodities, even virtual currencies. Notably, this is a portfolio structure used primarily for research purposes. The trio of writers Ronald Doeswijk, Trevin Lam, and Laurens Swinkels collated the necessary data to construct a historical average of all invested assets from 1970 to 2017. Thus establishing the ‘melting pot’ of investable assets that attempts to naturally hedge every bet. This portfolio is ever-changing from year-to-year, with an example of such changes over a single year (from December of 2020 to December of 2021) detailed below. In theory, this portfolio can be referenced as a starting point for the average investor.

Global Market Portfolio in Practice

In practice, this portfolio will not be the most reliable, the best performing, nor even the lowest risk. Practicing the portfolio requires the investor to stick with it and handle the psychological impact of managing its many pieces. Hypothetically, it’s a lot harder to move more of one’s hard-earned cash into obscure assets when they have been performing negatively for the past five years, are expected to perform negatively moving forward, and may not even have the investor’s conviction behind them. And yet, sticking to a diversified portfolio often requires it. Sticking to a complex portfolio over the long haul requires taking on potentially excruciating psychological risks.

Consequently, the easiest way to reduce the psychological risks of portfolio management is to simplify the portfolio. Instead of investing in every asset possible across the entire universe, an investor can invest in just a few. If we invest in the most recent estimated portfolio composition since 1970 and simplify it to the most basic parts it results in roughly the following, with caveats noted below. :

| Asset | Percentage |

|---|---|

| Developed World Stocks | 45% |

| Developed World Intermediate Bonds | 48% |

| REITs | 6% |

| Gold | 1% |

Notes:

- Emerging Market Stocks only became widely investable in the 1990s and thus are not included in the above.

- Again, this is a simplification. Especially so for World Developed Bonds which were split across multiple bond types in the study, arguably unnecessarily.

- If you own a home you already have outsized exposure to real estate. One may wish to replace this with another asset such as Emerging Market Stocks for increased diversification benefits.

- There are now index products such as GAA (Cambria Global Asset Allocation) that implement their own approximation of a Global Market Portfolio.

M1 Finance Implementation

M1 Finance is a fantastic brokerage for implementing the Global Market Portfolio.

M1 has zero transaction fees, dynamic rebalancing for new deposits, and can rebalance with a push of a button.

In addition, M1Finance allows you to set a cash threshold before buying with new deposits and automate transfers to align with your paycheck schedule.

Anyone based in the US can add this to their portfolio on M1 Finance by following this link and then clicking "Save to my account" or "Invest in this pie".

As always, not a recommendation to invest in any security or portfolio. Not financial advice. Use this as a starting point for your own research.