Larry Portfolio

Larry Portfolio in Theory

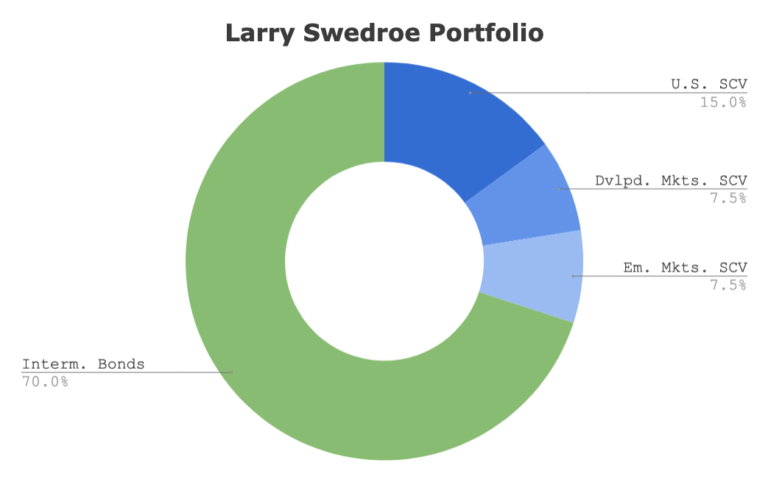

What might a portfolio designed to minimize downside risk while still maximizing the upside look like? The Larry Portfolio refers to equities in the portfolio designed and used by legendary author and financial advisor, Larry Swedroe. With a balance of high risk assets in a barbell formation, the Larry Portfolio seeks a different form of diversification. Yes, it still employs global diversification similarly to the Global Market Portfolio. However, it adds diversification in other ways through 'factor diversification' and the most efficient forms of downside protection available. The Larry Portfolio refers specifically to the equity allocation of the portfolio, with the downside protection of choice left up to the investor. Typically this is represented by Intermediate-Duration Treasury Bonds. However, the core of the portfolio is actually in the equity allocation which takes on different risks from the standard market fund. In theory, those different risks taken should result in a greater expected return to compensate for holding onto the portfolio long-term. This combines with the downside protection (bonds in this case) in order to achieve similar or greater expected returns at similar or lower risk. The result is a dominant portfolio, however, the portfolio includes only cheaper (Value) and smaller capitalization (small) stocks. Can we have too much of a good thing?

The table below provides an example of a 60/40 Stocks to Bonds ratio for the Larry Portfolio.

| Asset | Percentage |

|---|---|

| US Small Cap Value | 30% |

| Developed Ex-US Small Cap Value | 15% |

| Emerging Market Value | 15% |

| Intermediate-Term Treasury Bonds | 40% |

Larry Portfolio in Practice

Key concerns are indeed that the exact risks taken by the Larry Portfolio are via purchases of cheaper and smaller stocks than the average of the market. This exposes the Larry Portfolio to greater volatility and tracking error (the difference between a fund or portfolio and its respective benchmark). Tracking error can be both mentally and financially challenging. An investor can potentially lose out on a lot of relative returns during periods where the chosen benchmark is doing better than the Larry Portfolio. On the other hand, they can also potentially do very well during periods where the chosen benchmark - and the markets as a whole - are not. This difference can cause an investor to require withdrawals when markets are down, right before they would otherwise receive a huge increase in returns. As a result, certified financial professionals may be necessary to plan against and counteract increased financial and psychological risks.

M1 Finance Implementation

M1 Finance is a fantastic brokerage for implementing the Larry Portfolio.

M1 has zero transaction fees, dynamic rebalancing for new deposits, and can rebalance with a push of a button.

In addition, M1Finance allows you to set a cash threshold before buying with new deposits and automate transfers to align with your paycheck schedule.

Anyone based in the US can add this to their portfolio on M1 Finance by following this link and then clicking "Save to my account" or "Invest in this pie".

As always, not a recommendation to invest in any security or portfolio. Not financial advice. Use this as a starting point for your own research.